Mastering Technical Analysis in Forex Trading: Tools and Techniques

Mastering Technical Analysis in Forex Trading: Tools and Techniques

Forex trading, also known as foreign trade trading or currency trading, could be the world wide market place for buying and selling currencies. It operates twenty four hours per day, five days per week, letting traders to participate available in the market from everywhere in the world. The principal goal of forex trading is always to benefit from variations in currency exchange rates by speculating on whether a currency set will rise or drop in value. Members in the forex industry include banks, financial institutions, corporations, governments, and individual traders.

One of the essential top features of forex trading is their large liquidity, and thus large quantities of currency can be bought and sold without somewhat affecting exchange rates. This liquidity guarantees that traders can enter and leave jobs easily, enabling them to make the most of even little value movements. Additionally, the forex market is extremely accessible, with low barriers to access, allowing persons to begin trading with somewhat small amounts of capital.

Forex trading provides a wide range of currency pairs to deal, including major couples such as EUR/USD, GBP/USD, and USD/JPY, along with small and amazing pairs. Each currency pair shows the change rate between two currencies, with the first currency in the pair being the beds base currency and the next currency being the quote currency. Traders can benefit from both climbing and slipping areas by using extended (buy) or small (sell) positions on currency pairs.

Successful forex trading needs a stable knowledge of essential and technical analysis. Essential examination requires evaluating economic signs, such as curiosity rates, inflation prices, and GDP development, to gauge the underlying energy of a country’s economy and their currency. Complex analysis, on the other hand, involves analyzing cost charts and patterns to spot traits and potential trading opportunities.

Chance management can be important in forex trading to guard against potential losses. Traders frequently use stop-loss requests to limit their disadvantage chance and employ correct place dimension to make sure that not one industry can considerably impact their over all trading capital. Also, sustaining a disciplined trading method and preventing thoughts such as for example greed and concern are crucial for long-term achievement in forex trading.

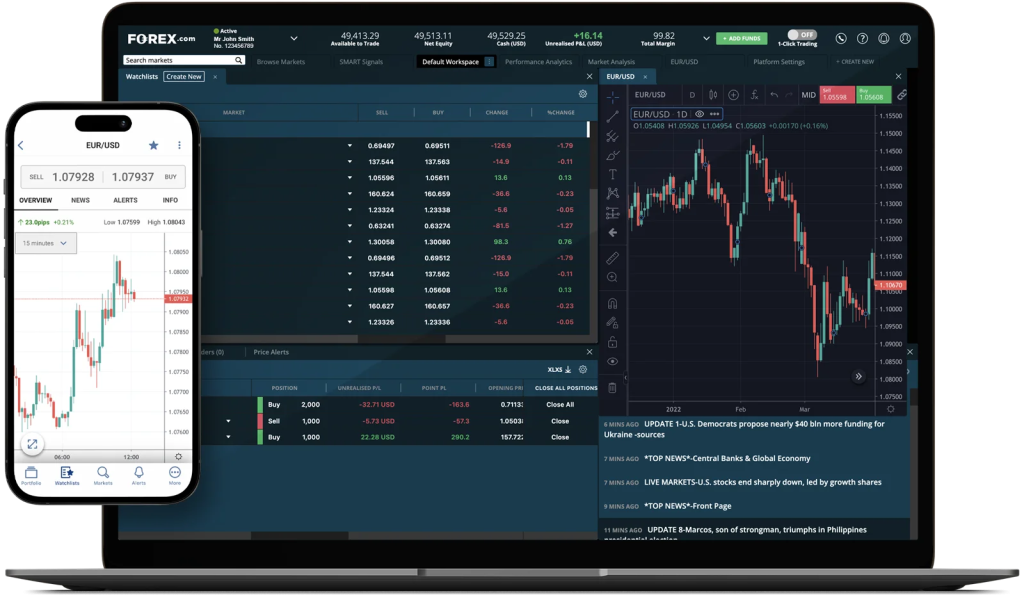

With the growth of engineering, forex trading has be accessible than ever before. On line trading programs and portable apps provide traders with real-time usage of the forex market, letting them implement trades, analyze industry knowledge, and manage their portfolios from any device. Furthermore, the accessibility to instructional forex robot sources, including guides, webinars, and test records, empowers traders to produce their abilities and enhance their trading performance over time.

While forex trading presents significant revenue potential, in addition, it provides natural dangers, including the potential for considerable losses. Therefore, it is required for traders to perform complete research, produce a sound trading technique, and consistently monitor market situations to make knowledgeable trading decisions. By adhering to disciplined risk management methods and staying educated about international financial developments, traders can improve their likelihood of success in the vibrant and ever-evolving forex market.